How to Handle Your 1099-R Code 7 to Ensure Your QCD Stays 100% Tax-Free

Episode 23

How to Handle Your 1099-R Code 7 to Ensure Your QCD Stays 100% Tax-Free

Published on February 18th, 2026

Episode 23 of Retirement Tax Matters tackles a critical reporting gap that can cause high-net-worth retirees over age 70½ to be taxed on their charitable giving that was supposed to be tax-free. While the IRS recently introduced Code Y for Box 7 of Form 1099-R to explicitly identify Qualified Charitable Distributions (QCDs), many major custodians are still using Code 7 (Normal Distribution) in 2026. This reporting delay means that unless you remember to notify your tax preparer to adjust your IRA Distribution line of your Form 1040, the IRS will treat your tax-free gift as fully taxable income. For retirees between $2M–$8M, where household QCDs tend to be on the higher side, this paperwork oversight can trigger thousands in unnecessary taxes and high Medicare IRMAA surcharges. Garrett and Adam explain how to review your prior returns for this error and why a proactive hand-off between your advisor and accountant is the only way to ensure your you don’t pay unnecessary taxes or end up with a headache of needing to file an amended return later.

Key Tax Planning Questions

Question 1: How do I report QCD on my tax return?

While Qualified Charitable Distributions (QCDs) are an excellent strategy for high-net-worth retirees to better align their giving with their values, the primary challenge is that the current system for reporting these gifts is not intuitive and very easy to mess up. As a CFP® professional, I do not prepare tax returns or give specific tax advice. However, I do work closely with my clients and their tax professionals to audit the results and ensure the planning we did during the year actually makes it onto the final return.

In my experience, most investment custodians do not determine the taxability of your gift on your year-end forms. For the current 2025 tax year (reported in early 2026), I am still seeing Form 1099-Rs from Charles Schwab that use Code 7 in Box 7. While the IRS has introduced a new Code Y specifically to identify QCDs, its use is currently optional, and I have yet to see it widely adopted.

This reporting gap means that a 1099-R might show a $100,000 distribution that includes a $40,000 tax-free QCD, yet still list the entire amount as a taxable distribution in Box 2a. If you simply hand this form to your tax preparer without a specific note, you risk paying unnecessary taxes—an oversight that could cost nearly $10,000 for a household in the 24% bracket. It could also trigger unnecessary Medicare IRMAA surcharges or 3.8% net investment income tax.

When I am auditing a client’s draft or finalized return, here are the observations I look for to confirm a QCD was handled correctly:

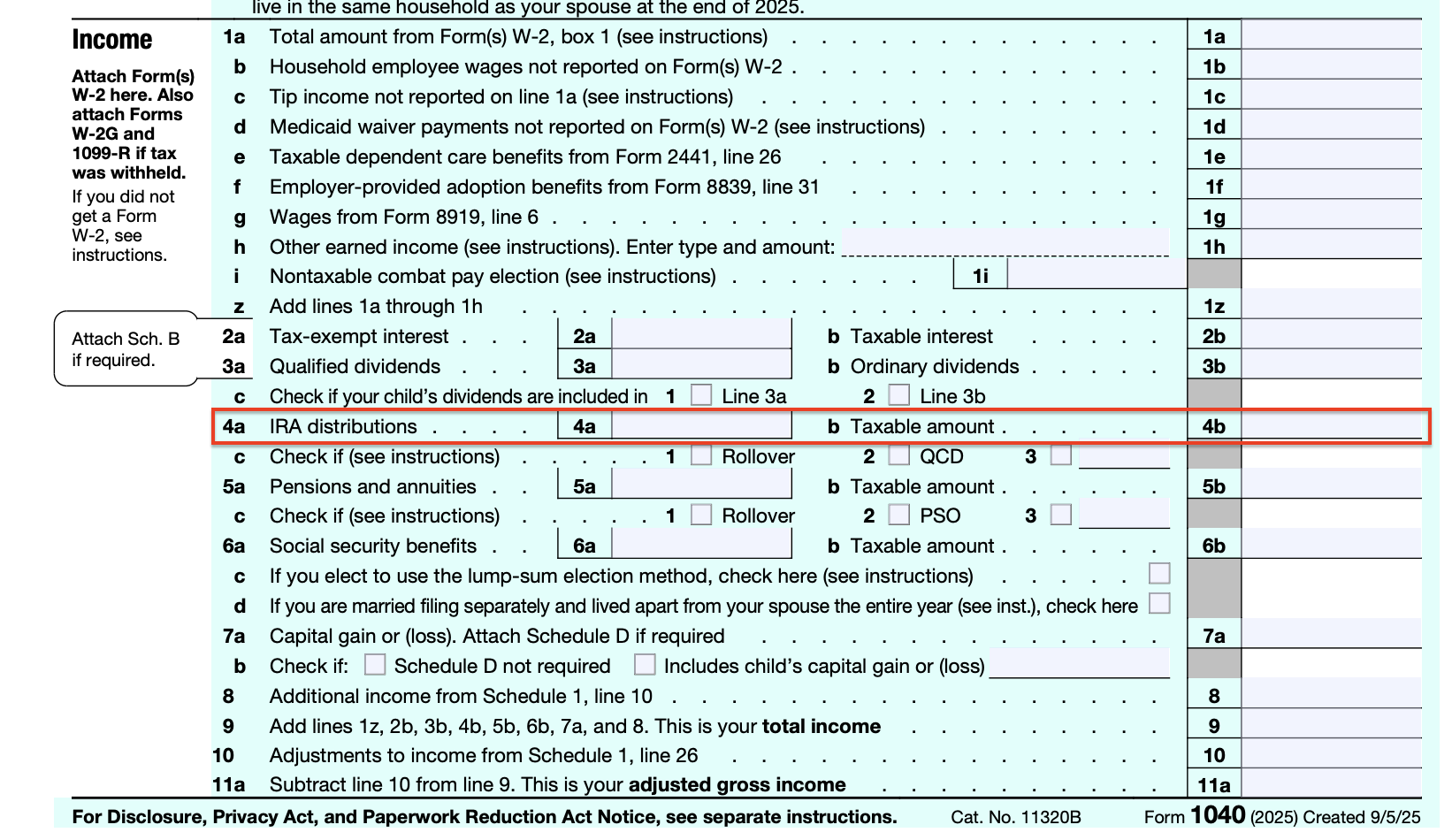

Form 1040, Lines 4a and 4b: Is there a visible difference between Line 4a (Total IRA Distributions) and Line 4b (Taxable Amount) that matches the dollar amount of your charitable gift?

The QCD Notation: I look to see if the tax preparer (or software) manually wrote the letters QCD next to Line 4b. This is one signal that I see tax preparers or tax software employ to notify the IRS of why the amounts in 4a and 4b don’t match.

I also recommend that retirees who have utilized QCDs in the past take a moment to review their old tax returns. If you realize your charitable gifts were inadvertently included as taxable income, you can often work with your tax preparer to file an amended return. In my experience, getting those tax dollars back is usually well worth the time and coordination required to clean up the error.

Question 2: I think my accountant messed up. My tax return says I have $100,000 in taxable IRA income, but $40,000 of that was sent directly to a qualified charity as a QCD. Why is there no difference between my total distribution and taxable amount on my return?

In my experience, when a Qualified Charitable Distribution (QCD) appears as taxable income on a tax return, it’s rarely a competency issue on behalf of the tax preparer. Instead, it is almost always a communication issue rooted in the way the tax reporting system is designed.

Your tax professional is trained to follow the paper trail. As a CFP® professional, I often see clients receive a Form 1099-R from their custodian (like Charles Schwab) where Box 7 is marked with Code 7, signaling a Normal Distribution. Even though the IRS has introduced a new Code Y specifically to identify QCDs, its use is currently optional, and most major institutions have not yet adopted it for the 2026 filing season.

This means your accountant is likely reporting exactly what your tax forms declare. If you didn't explicitly let your tax preparer know the $40,000 was a gift to a qualified charitable organization, they have no way to know that those dollars should be excluded from taxable income.

To ensure your charitable intent is honored and you avoid paying unnecessary taxes, I recommend the following:

QCD Summary For Tax Preparer: Before handing over your 1099-Rs, provide your tax preparer with a simple summary listing the date, amount, and recipient of each QCD you performed during the year.

Remember QCD Exceptions: Remember that for a QCD to be tax-free, you must be at least age 70½ at the time of the gift, and the funds must go directly to a qualified charity—not to a Donor-Advised Fund (DAF) or a private foundation.

One significant benefit of Tax-Return Driven Financial Planning is that you can offload this coordination to your financial planner. By having your advisor and tax professional connect directly to review the return draft, you can delegate this annual task and spend your time doing other more valuable things with your time.

Full Episode Transcript

Adam: Good morning and welcome to Retirement Tax Matters. I'm Adam Reed. This is Garrett Crawford, our resident CFP® professional. We're excited to dive into another week and another topic of important matters to high-net-worth retirees.

Garrett: This is a good one and a timely one for today.

Adam: It is. Every industry has its seasons and its cycles. This is one of those for us and for a lot of our clients. You're coming off the New Year where everybody relaxed and spent time with family. A lot of our retiree clients are kind of hanging out and planning fun things for the year. Maybe our snowbirds are down in Florida or Texas, and all of a sudden tax forms come knocking.

Garrett: Right in the mailbox.

Adam: Right in the mailbox, or on your laptop nowadays. It’s an important time of year to be talking about the pitfalls and things people might miss. Our podcast specifically focuses on these little efficiencies throughout the year that help maximize what you’ve worked for in retirement—making sure it doesn't feel like the IRS is your biggest beneficiary.

I think one of those places that a lot of our clients utilize is QCDs. These are Qualified Charitable Distributions, which are a powerful tool, especially from age 70½ and on, for tax-free giving. But there is one catch we are already seeing this year on tax returns we're reviewing. Garrett, what is something to have your feelers up about when it comes specifically to QCDs, tax forms, and how those interact with your tax preparer?

Garrett: I’m going to be even more aggressive and say that while most retirees have heard about QCDs, this is a big mistake that can cost you thousands of dollars in extra taxes just because you were unfamiliar with the way the system worked. I think the custodians are trying to fix this, but for now, we need to jump right into the point: don't make this mistake.

To do a Qualified Charitable Distribution, you send an amount from your traditional IRA—money you've never paid tax on—directly to a charitable organization. For example, if someone does a $30,000 QCD to their church, that check goes from the custodian (like Schwab) to the charity. You get a 1099-R tax form around February. That form represents a distribution from a retirement account. Even though you sent $30,000 out as a tax-free QCD, that 1099-R is going to show a distribution of $30,000.

The big mistake is if you don't let your CPA know you did that QCD, you're going to end up paying tax on that entire amount. I just pulled a 1099-R this morning for the 2025 tax year. This person distributed $18,000. The form from Charles Schwab says: Gross distribution, $18,000; Taxable amount Box 2a, $18,000. If you hand this to your CPA without a disclaimer, they are going to add that to your taxable income.

Adam: Won't the tax preparer know based on the codes?

Garrett: In Box 7 of the 1099-R, there is a distribution code. In this case, it is distribution code 7, which stands for a normal distribution. Schwab is telling your tax preparer that this was a normal taxable distribution. Custodians don't actually know if that money went to a qualified charitable organization. The IRS has no way to prove it was sent to a charity just from the automated form, so they default to Code 7. You have to remember to tell your tax preparer, or remember when you're using TurboTax, that you did a Qualified Charitable Distribution.

Adam: If you're in the 22% bracket, that’s $1,500 on an $18,000 distribution. That’s a vacation or a bunch of nice dinners. It’s substantial.

Garrett: For our niche, those QCD amounts are often larger. You can't miss this. Adam, you mentioned people look for the big picture. Is there another code that might be appearing on these forms?

Garrett: Early in 2025, the IRS introduced a new code. Instead of Code 7, they are introducing Code Y to identify a QCD. It is already legal and allowed, but custodians like Schwab just haven't adopted the policy yet. I envision someday soon this will be fixed, but for the 2025 and likely the 2026 tax year, big custodians are slow to move. You need to write it down and email your tax preparer so you don't forget.

Adam: If someone misses this Code 7 and doesn't communicate it correctly, is there a solution? What does that look like for DIY-ers or our clients who realize they might have missed this on a previous return?

Garrett: Part of our tax-return-driven financial planning process is that after you file, you should review that return. We read through our clients' returns looking for mistakes like this. Usually, it's a lack of communication to the tax preparer more than the preparer messing up, but mistakes happen. Look at your 2024 or 2023 tax return. On Form 1040, look at the IRA distributions line. There should be a difference between the total distribution and the taxable amount, often with the notation QCD next to Line 4b.

If you find you didn't get credit for it, you can amend your return. You'll file Form 1040-X. It’s not too bad if you work with a professional. You’ll eventually get a rebate check, though the IRS is very slow right now. But there is a way to get that money back.

Adam: That’s a great reminder as people head to their tax preparer's office. We’re in the business of adding value and finding these efficiencies. If you did a $40,000 QCD, that's not chump change. If you're on the podcast, I'm holding up our year-end tax planning checklist. You can download this on our website to see things that can save you money and make your retirement more efficient. Garrett, any closing thoughts?

Garrett: I encourage people to use that checklist. It’s the same process I use with clients to ensure we don't miss these seasons. It’s helpful for keeping everything in order.

Adam: Absolutely. This is Retirement Tax Matters. Thank you for tagging along. Subscribe, follow, and give us a like. I'm Adam Reed. This is Garrett Crawford. Hope y'all have a great day.